About Us

Who are First Element Insurance Planners?

COMPANY

First Element Insurance Planners (FEIP) partners with fee-only planning firms to provide consistent, objective risk management resources without creating additional overhead or compromising fee-only status.

Wealth management firms are progressively shifting to a fee-only planning model with the goal of providing comprehensive, holistic guidance. First Element Insurance Planners was created to serve as a strategic partner to fee-only firms to make it comfortable and easy to address risk management in a process-driven, proactive manner.

The insurance and estate planning experts at FEIP understand financial planning and the need to put solutions ahead of product. The firm’s sole focus is providing proactive, objective advice as it relates to clients’ risk management needs.

Benefits of an FEIP Partnership

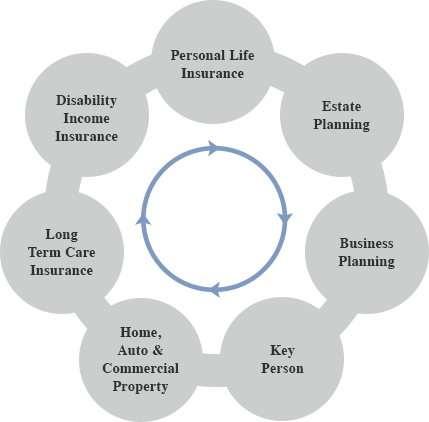

First Element Insurance Planners provides consultative, interactive guidance in the areas of life insurance, long term care insurance, disability income insurance, estate planning, business succession planning and executive benefits.

FEIP brings value to advisory firms who desire to provide holistic, comprehensive planning for their clients. For those firms, the benefits of an FEIP partnership include:

Strategic Partner

BUI is a nationally recognized provider of services to financial service and insurance professionals and their affluent clients. Through this partnership, our firm is better positioned to take a consultative approach to address some of your most important planning concerns. Their core expertise in strategic planning combined with a straightforward, objective approach delivers comprehensive solutions for our most valued clients.

Because of the strategic relationship with BUI, First Element Insurance Planners not only has preferred access to dozens of the country's most highly rated insurance companies, but also has the case design, advanced planning and underwriting support to handle nearly all aspects of insurance planning.

Meet the Team

Daniel Sullivan, JD

Managing Director

dsullivan@firstelementinsurance.com

Dan combines his legal counseling experience with the First Element team’s high-level insurance expertise to help fee-only advisory firms provide client-friendly risk management solutions to their clients in a proactive, process-driven manner. Just as every client’s circumstances, goals and objectives are unique, each RIA has its own perspective and process. Dan takes a consultative approach to working with each firm by first learning about how advisors engage their clients and what the unique planning process is for that particular firm. By learning these critical aspects, Dan tailors the resources at FEIP to the firm, with the goal of comfortably folding risk management into the firm’s existing wealth management process. Dan lives in St. Louis, Missouri, with his wife, Casey, and two children. He enjoys running, bicycling, spending quality time with his family, and drinking good beer with good friends.

Lauren Gelber

Director of Operations

lgelber@firstelementinsurance.com

Lauren is committed to optimizing the company’s ability to consistently provide an exceptional client experience. With over a decade of experience in the insurance industry, Lauren possesses a strong understanding of the intricacies that underpin successful operations throughout the entire insurance planning process. Lauren lives in St. Louis, Missouri, and enjoys reading, hiking and attending food truck and festival events with her family.

Danny Kaufmann

Risk Management Consultant

dkaufmann@firstelementinsurance.com

Danny is passionate about guiding clients towards insurance solutions based specifically on their goals and objectives. Danny blends critical thinking and communication skills to provide clients an objective and personalized insurance planning experience tailored to their needs. Danny has nearly a decade of experience in the life insurance industry, advising a wide array of individuals and businesses on risk mitigation strategies. Danny lives in St. Louis, Missouri, with his wife and two young children, and he enjoys kayaking through Missouri’s waterways and camping with his family.

Brian Flynn

Risk Management Consultant

bflynn@firstelementinsurance.com

Brian takes great pride in providing objective insurance guidance to fee-only advisors and their clients based specifically on clients’ needs. Brian starts the process by listening to what is important to the client before bringing solutions to the table to address their needs. With nearly three decades of experience in the insurance industry, Brian offers detailed and comprehensive insurance planning advice focused on the client’s best interests. Brian lives in Tampa, Florida, with his wife, Kathy, and daughter, Kylie. In his free time, he enjoys golfing, bicycling, traveling and a good red wine.

Emily Warren

Risk Management Consultant

ewarren@firstelementinsurance.com

Driven by a passion for helping clients protect their financial plans, Emily combines nearly a decade of insurance expertise with a commitment to empowering clients. Her dedication to clients is evident in every interaction, and she excels at collaborating with financial advisors to enhance clients' financial health. Based in Tallahassee, Florida, Emily lives with her husband and two young children. In her free time, she enjoys visiting the beach, hiking, experimenting with new recipes, and exploring local coffee shops, all while cherishing quality time with family and friends.

Nicole Scholten Baker

Administrative Assistant

nscholten@firstelementinsurance.com

Nicole concentrates her efforts on helping the First Element team operate efficiently. Her organizational and planning skills ensure that advisors and clients enjoy a smooth and streamlined client experience. Nicole lives outside of Charlotte, North Carolina, with her husband and two cats, Binx and Salmon, and she enjoys travel and spending time with family.

Operations & Administration

Michelle Johnson

Application Assistance Specialist

mjohnson@buiusa.com

Debbie Tate

New Business Consultant

dtate@buiusa.com

Suzie Terry

New Business Consultant

sterry@buiusa.com

Mickey Vogt

Case Design Consultant

mvogt@buiusa.com

Cindy Cox

Case Design Consultant

ccox@buiusa.com

Dawn Cameron

Policy Service Support

dcameron@buiusa.com

Advanced Planning

Brian Seigel, JD, AEP®

Estate & Business Planning Consultant

bseigel@buiusa.com

Chris Hooper

Chief Underwriter

chooper@buiusa.com

Michael Tessler

Risk Management Consultant

mtessler@buiusa.com

Brant Steck, CFP®

Risk Management Consultant

bsteck@buiusa.com

Philosophy

There are times to take risk in the financial planning process. Insurance and estate planning, however, are not the time.

Many fee-only advisors (and their clients) experience frustration with insurance policies not performing as originally intended. Hypothetical returns and non-guaranteed dividends commonly create unrealistic expectations that almost certainly require future remedy. While taking risks in a portfolio is typically necessary for many investment clients, taking risks with insurance planning is typically not.

If it is not guaranteed in the contract, it is not guaranteed.

FEIP prides itself on meeting and exceeding expectations. From years of experience, we tend to favor products that are fully guaranteed by contract, allowing us to consistently meet expectations and keep advisors and their clients happy.

Insurance planning is not always the answer.

Through the collaboration of estate and insurance planning experts, FEIP strives to find the best solution for the client, not necessarily the best product.

The client is YOUR client.

FEIP’s goal is to fill a void for fee-only advisors through expert partnership in the areas of risk management planning. The goal is provide consultation, advice and direction to fee-only advisors who wish to have a truly holistic model. When a firm partners with FEIP, the firm’s clients remain their clients.